The Tech Sales Newsletter #98: The AI job is not finished

In this article, we will go through the Coatue "East Meets West" conference deck (EMW 2025). It's one of the most interesting analytical pieces that come out of the VC world because Coatue itself invests in both public and private companies. This helps alleviate some of the bias that comes from focusing on a "single stage" in the lifecycle of a company and requires more first-principles thinking.

Read the full thing for the 2030 forecast of top 40 companies.

The key takeaway

For tech sales: The tech sales opportunity in AI and cloud infrastructure software is unprecedented. Currently a lot of it is concentrated in private companies, which means that reps need to adjust their career strategies if they want to take full advantage.

For investors: The most interesting and high growth opportunities today are not available for the majority of investors. This is one of the few periods in history when companies that should've been public by now are instead able to fully scale and operate with private funding. While this will hopefully change over the next 12 months, it's also an indication of a shift in the playing field.

The AI supercycle and other bullish themes

Source: EMW 2025

One of the interesting parts of tech growth has less to do with the triggers in technology, but the fact that each wave is bigger than the previous one, partly because it benefits from the distribution and value creation of everything that preceded it. The AI play is often misunderstood as a "new product", when in reality the market potential is so high partly because it allows for much deeper penetration and productivity from the already existing computing infrastructure that we have today.

Source: EMW 2025

The market cap share of the top players today compared to 10 years ago is significantly larger, with substantial multipliers even when compared to 5 years ago. The growth in the technology sector has been exceptional, with the majority of the value concentrated in cloud infrastructure software.

Source: EMW 2025

Now the supercycle concept here is an interesting choice since it represents a very narrow mental model focused on the idea that investing in this cycle will have outsized returns compared to historical cycles because we will see significantly larger growth before the next leg of innovation (whatever or whenever that might be).

The argumentation, however, is weak if only fixated on the mental model of investing. So let's contrast this with the recent talk by Andrei Karpathy at YC:

Source: Andrej Karpathy: Software Is Changing (Again)

Now this is a lot more interesting since it introduces the idea of fundamental shift of how we leverage computing through software. In the last 10 years we've had two significant shifts - one was the introduction of the idea of model weights as a way to determine software performance, which led to LLMs which started the new wave of programming compute through natural language. The idea of the supercycle makes a lot more sense through the lens of a massive expansion of the ability to program compute, combined with the wide availability of such hardware due to the previous waves of mobile and cloud computing.

Source: EMW 2025

This of course is not just a bet the VCs are making, the big players have been moving significant amounts of liquidity into both hardware and software. This is not something their investors actually want (since institutional players will always prefer 10% returns as conservative investors over 1000% returns as aggressive risk takers). The leaders of those companies had to push back hard while making these CAPEX decisions.

Source: EMW 2025

As cloud computing is becoming widely available, more and more workloads are moving to serverless. With AI-native stacks, the % of serverless vs total software budget is likely to end up in the 80s-90s by 2035.

Source: EMW 2025

The "experts", who've never sold a penny's worth of software, will of course disagree with such bullish predictions.

Source: EMW 2025

One of the biggest arguments made in the presentation is that while the macro environment and overall sentiment is not great, AI has a bigger role to play than just growing investor portfolios. AI-driven productivity could usher a new age of GDP growth, which would outpace the growing debt and allow for stabilizing the financial system.

Source: EMW 2025

Source: EMW 2025

This is nicely visualized here by comparing the forecasted debt to GDP ratio as things are today versus what reality could look like in an AGI/ASI world.

Source: EMW 2025

Venture capital is going aggressively after that opportunity, with AI investments clearly starting to outpace regular software development.

Source: EMW 2025

This new reality has also led to large-scale capital being pushed into private companies, with significantly more liquidity available than ever before. Historically companies that needed to scale had to go public - there simply wasn't readily available funding in the billions on the market. The AI era has unlocked a completely different dynamic, with OpenAI being able to raise $40B on the private markets just this year.

Source: EMW 2025

The lack of need to go public is partly driven also by some truly groundbreaking revenue figures we are seeing from the top companies. While I was (and remain) bearish on the long term prospects of Anthropic, it's really difficult to argue with the impressive achievements they've accomplished in acquiring new business, literally tripling the company in the span of 5 months (when already above $1B ARR).

Source: EMW 2025

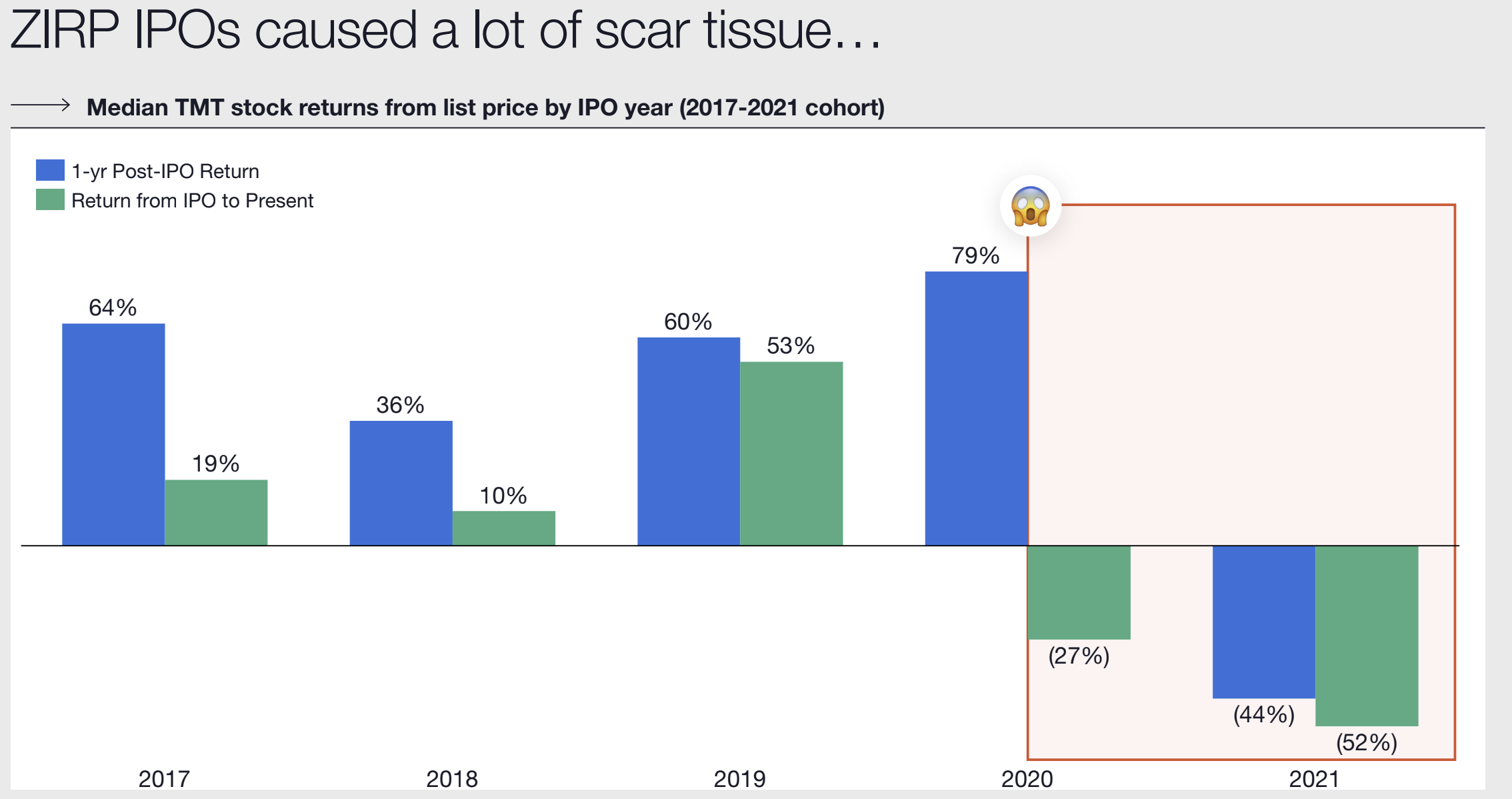

IPOs are also seen as less interesting because the returns have been, well, ugly. Pretty much any company that went public after 2020 up until last year has been a loss maker for investors and a frustration for employees (as their hopes and dreams of becoming overnight millionaires rarely materialized).

Source: EMW 2025

For the companies that went public more recently and did well, most of the success was driven by going public with a healthy business that was already profitable.

Source: EMW 2025

This is becoming even more important at a time when growth in public companies is increasingly slow. If “minimum of 25%” growth was an expectation pre-2023, today it’s a luxury for most. Quota attainment has followed a similar trend.

Source: EMW 2025

The practical reality is that high growth, both in quota attainment and stock valuations, is currently centered around private AI-first companies.

Source: EMW 2025

The metrics speak for themselves. While you can always achieve a great year in most companies, your odds of success are much higher when riding a growth wave and it's clear where that opportunity lies right now.

Source: EMW 2025

While other opportunities are easily overshadowed by the exceptional growth we saw at OpenAI and Anthropic, the infrastructure and application layer continue to present opportunities with significant multipliers.

Source: EMW 2025

The market potential is in both augmentation of existing workflows, as well as full replacement. The market opportunity in most industries measures in the hundreds of billions.

Source: EMW 2025

Coatue's recommended metric to assess your next step as a company is also a very good way to assess the market opportunity at your current org if your company is not yet public.

Low growth and unprofitable = bad times.

Low growth and profitable = could be a growth play from a place of strength.

High growth and unprofitable = cuts incoming.

High growth and profitable = IPO time.

Source: EMW 2025

Ah, the five year forecast of the most valuable companies in the world. I'll be honest, it's quite reasonable based on where we stand today, but I expect a lot of the "legacy" mindset orgs to be punished much harder by the market. The fun part is that there could be at least one company that doesn't exist today, that sneaks in the top 40.

Looking forward to seeing how it all plays out.