The Tech Sales Newsletter #55: The Snowflake, erm, cold season

Sales anon,

This week we are looking at the bear case for Snowflake as a tech sales opportunity.

The earnings call that went downhill

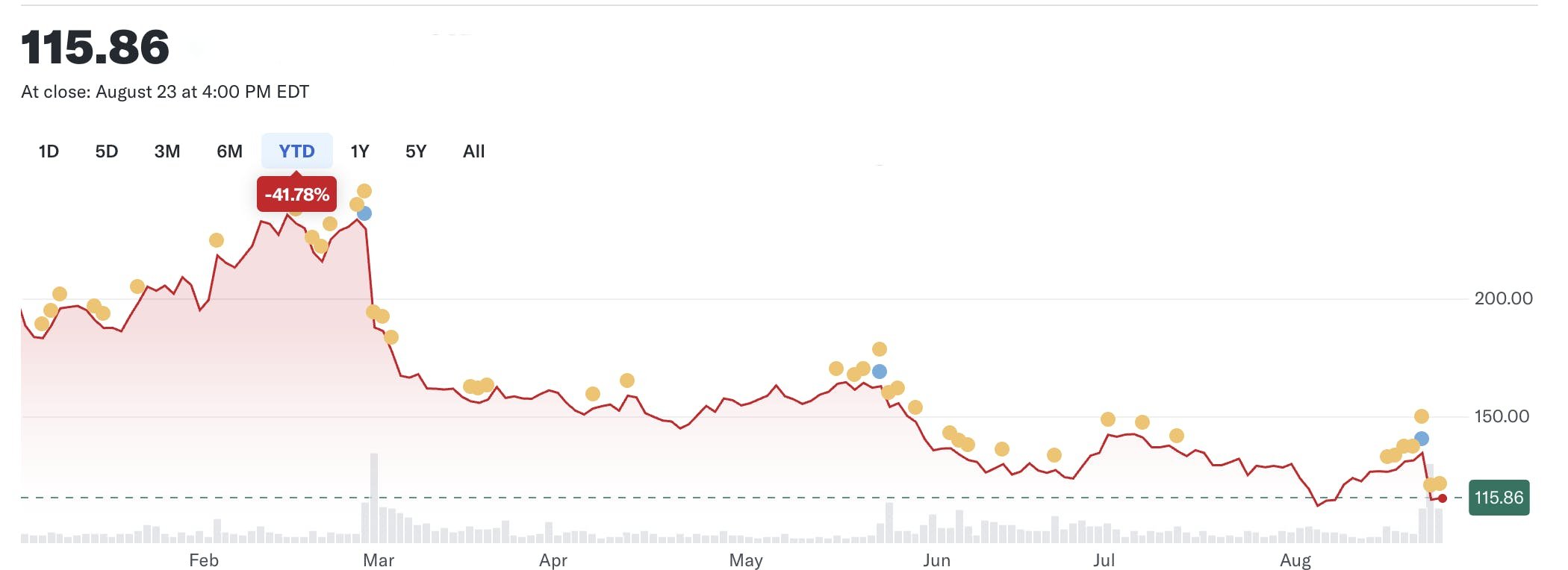

Source: The stock price of Snowflake in the week prior to this article (8/23/24)

Snowflake is one of the most important players in cloud infrastructure software and until recently was seen as a mandatory part of the AI tech stack, together with Databricks.

This image has taken quite the beating in the last months, with both the stock and the public reputation of the company going trough some rough times.

The goal of this article is to answer a simple question - is Snowflake an APPLY, OBSERVE or SKIP for a tech sales rep.

If we take the investor angle, the last earnings call inspired little confidence. At a high level:

1. YoY growth is decelerating, at a time when they should've overcome the cloud cost optimisations. This also applies for their second half guidance, i.e. this year is expected to be slow across the board.

2. The competitive landscape has evolved significantly, but Snowflake has not really been able to pivot in a larger platform play. The acquisitions to expand into other parts of cloud infrastructure software in a way that could've given them a deeper consolidation play has not materialised. Databricks is offering a cheaper data lake that performs better in the context of ML data science (i.e. AI play) and legacy structured data is simply not offering the same value as it used to.

3. The overall tone of the CEO at this stage is very defensive across the board. The financial performance is a reason to be defensive. The lagging new product strategy is a reason to be defensive. The extremely poor handling of the recent cybersecurity breach is a reason to be defensive. When Berkshire Hathaway dumps their full allocation acquired during the IPO, there are reasons to be defensive.

Speaking of the cybersecurity breach:

Source: Mandiant post-mortem

Essentially what happened was that trough multiple other breaches with other vendors, a threat actor had been able to identify at least 165 Snowflake customers with currently active credentials that could be used to access their instances. Those accounts had no MFA activated or access whitelists, which made it easy to repeatedly breach them.

There is significant responsibility for this with the customers and their cybersecurity teams who did not identify these credentials as at risk or enforce more stringent policies for such high-value asset.

However at the end of the day Snowflake themselves could've detected this usage or monitor the dark web for credentials of large customers being sold. Both of these would be part of an advanced, but reasonable cybersecurity policy related to protecting critical user data, even if the customers themselves are making mistakes.

This did not happen. Not only it didn't happen, but Snowflake was slow to even support investigations into those breaches, while multiple customers suffered essentially catastrophic breaches (Ticketmaster leaked the data of 680 million customers; Santander Bank had all personal and financial information of their US employees leaked, together with all their customers; AT&T's network entire usage for a period of 6 months in '22 was leaked).

The approach carried over during the earnings call, essentially having the CEO talk about "muddled headlines" and absolving Snowflake of any responsibility or role to play in this fiasco. More importantly, "it did not impact consumption!" which is interesting because by definition, consumption trends would be lagging indicators - they show up after customers were able to displace you and start moving away workloads.

The delay on both technical launches for GenAI products and the expectation from the leadership that any impact of revenue will be felt the earliest next year, is also raising some significant concerns as we are seeing Azure, AWS and GCP each announce billions of AI-related revenue. For a company that in theory is a critical part of the AI stack, having minimal benefits raises significant red flags. The quality of developer enablement doesn't help:

So what is the tech sales take?

And Kash, on your question for me on the sales comp changes, what I was meaning by that is we really bifurcated our sales force into the acquisition reps. And those customers, they're landing today.

We really haven't focused on trying to land the right type of customers that can grow. We think they will have a meaningful impact on revenue next year with those new ones. And then also, the new muscle that we've been building in the sales organization where the reps are just being paid on consumption is what is driving them. That's really the growth within customers' consumption.

It's a new muscle for them to learn how to go and find and help forecasts new workloads coming online. In that muscle they're developing we see is going to have a really positive impact in 2026 for us.

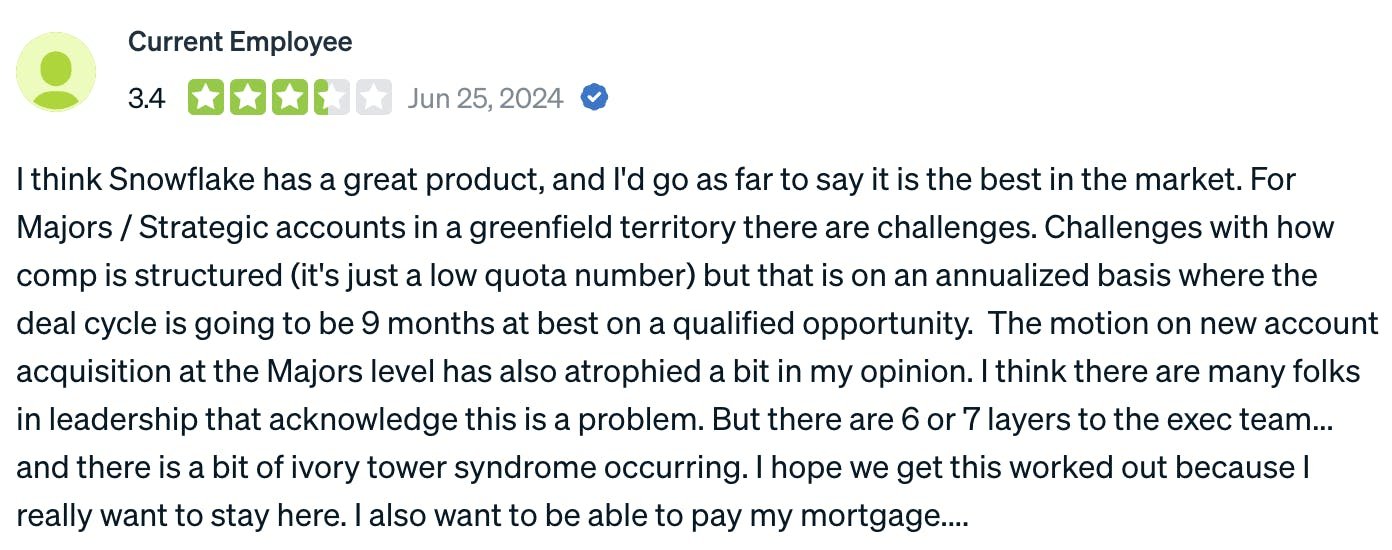

Snowflake recently changed their comp plan to focus on incentivising consumption, which the CFO positioned as important but something that will pay dividends later, because of the change of sales motion. Let's see how the reps feel about it:

Source: RepVue Snowflake page

Source: RepVue Snowflake page

So this is where we get to the core part of the challenge that a rep would have today at Snowflake.

On one side, the core product is good enough to be sold and scale in the majority of customers. The competition is competent but at this stage Snowflake is widely accepted as one of the most dependable data warehouse products on the market, which also means not a lot of buyers will face internal scrutiny on the core product.

Where things start to get tricky is growth and expansion. The market for structured legacy data is saturated and growth is incremental. A lot of this growth was also reduced due to technical changes and optimisations on the product side, which led to smaller deals.

This means that reps need to have a strong upselling motion within the platform, which right now they simply lack. With the delay on the most obvious play (ingestion of structured and unstructured data for LLM fine tuning and utilisation) and no recent acquisitions that would allow to upsell into a completely different part of cloud infrastructure software (observability would be an interesting candidate for example), Snowflake reps are stuck into fighting for smaller workloads with bigger discounts.

When you add the big shift in approach and compensation under a consumption-oriented comp plan, many reps will be feeling underpaid and lacking the right level of support to scale. We also have massive public blunders like how the cybersecurity breach was handled, a negative investor view of the company, a shaky new CEO and RepVue reviews that hint at significant downgrades of both sales culture and pay.

Right now my advice is to SKIP Snowflake until we can see a change of narrative, both internally and externally.