The Tech Sales Newsletter #97: The Deel conspiracy expands

Rippling submitted an amended complaint last week that includes more details around Deel's alleged spying activities across multiple competitors.

As the case has expanded, Deel's response has been ineffective, to say the least. Today's article focuses on highlighting what can happen if you are an employee who switches companies and decides to play along with shady business practices.

The key takeaway

For tech sales: The Deel-Rippling saga takes a new turn, as regular sales reps are starting to get named in the lawsuit. My warning is no longer hypothetical, but a concrete reality for the individual named "Conspirator-1". Never forget, sales anon, you can reverse bad performance but you can't survive a bad reputation.

For investors: The reputational damage to the network around Deel so far has been limited. The game, however, is shifting, with new companies joining the Rippling lawsuit. What happens next if the court decision goes against Deel and a16z?

The gangs of Deel

We'll start with the most recent coverage from TBPN (prior to the amended lawsuit), since they highlight something that's been top of mind for me - this is one of the biggest stories of the year, yet most don't realize that or care all that much.

The lack of a stronger industry reaction has mostly been due to a16z going very aggressively in defense of Deel, rather than pushing for immediate changes. I covered this in the last article, but the approach here has been a rare L for a16z, since they decided to stick to their (recent) principles of protecting founders at all costs, rather than the realistic approach of evaluating on a case-by-case basis. I would go as far as to say that they are very aware this is a short-term mistake, but might believe that it will pay off long-term by cementing their reputation as founder-focused.

With all due respect, if we're covering for founders being exposed as criminals, then we've lost the plot.

Source: Case No. 3:25-CV-2576 (CRB)

This is a helpful visualisation of the events so far. Let’s focus on the latest developments:

This case is about a criminal syndicate that operated from the shadows of a multibillion-dollar technology company—Deel. At its helm are CEO Alex Bouaziz and his father Philippe Bouaziz, who directed a racketeering enterprise that steals and repurposes the hard-earned work of its victims to unlawfully fuel Deel’s growth (the “Bouaziz Racketeering Enterprise”). This enterprise encompasses several senior Deel executives, collaborative outsiders, and carefully groomed, disaffected employees turned corporate spies from rival firms. To date, at least four distinct corporate victims have been identified—each targeted, infiltrated, and compromised to serve the aims of the Bouaziz Racketeering Enterprise.

“Racketeers in control” has a bit of a buzz around it.

It's time for you to join the Tech Sales Community and take the next step in your career.

The primary focus is on the weekly calls. Calls take time, they can be inconvenient, and often require vulnerability.

But that's how you learn and change.

For those that want a more hands-on approach, there is the option to also get a 1-on-1 call every month where we build and execute on a plan that helps you win.

Source: Case No. 3:25-CV-2576 (CRB)

And this information wasn’t merely stolen—it was weaponized in real-time by Deel’s CEO. In one jarring example, on the same day a Rippling sales representative met with a prospective client, that prospect received an unprompted WhatsApp message from “alex from deel” (Alex Bouaziz), stating that he “[h]eard” they were “using a few other products than deel” and suggesting they speak. “That scared TSO of me,” the prospect later wrote, and then asked his Rippling contact:

On Deel intelligence: I am just curious to know how they [Deel] would know [that the prospect was considering Rippling] in real time. I haven’t posted anything on LinkedIn nor went out asking for quotes. Do you have a perspective on that?

Rippling did not “have a perspective” on Deel’s seemingly real-time intelligence then. It does now. This was not competitive intelligence this was theft directed by Alex Bouaziz who was stealing Rippling’s confidential information and brazenly exploiting it like parts in a high-tech chop shop.

“Deel speed” indeed.

Given the brazenness of the conduct and Philippe Bouaziz’s boasting of having “spies at other companies,” it is unsurprising that other corporate victims have emerged.

Underscoring the Bouaziz Racketeering Enterprise’s broader fixation beyond Rippling, additional forensic analysis revealed that the spy also searched Rippling’s Slack—an internal company communication tool, enabling employees to communicate through group channels or direct messages—to find information targeting nine Deel competitors over 300 times by running the following search terms: “Papaya,” “Velocity Global,” “Remote,” “G-P” (Globalization Partners), “Omnipresent,” “Oyster,” “Boundless,” “Payzaar,” and “Remofirst.”

Meanwhile, Deel whistleblowers have reported that competitor hires were celebrated at Deel All-Hands meetings for the information they brought with them. No wonder then that several parties—including major Deel competitors and a startup accelerator—have uncovered eerily similar conduct by Deel or its associates to obtain their confidential information and trade secrets. With multiple investigations ongoing, Rippling expects the full extent of the Bouaziz Racketeering Enterprise will soon be revealed.

The case now introduces a new angle - the expanded activity of Deel around other competitors, for which they also leveraged Rippling's company access to get additional information.

Deel has attempted to spin this dispute as a tech rivalry gone bad. But tech rivals don’t bribe employees to spy. They don’t launder payments through crypto and family members.

They don’t coach witnesses to lie under oath. When they are caught, they don’t destroy evidence and take refuge in non-extradition territories like Dubai. And they certainly don’t replicate these schemes repeatedly across an industry.

Probably the strongest "where there's smoke, there's fire" signal here is Deel's inability to both disprove the activity within Rippling's network, as well as their only real defense being "but we think they did it first." This brings us to the most material new information:

Conspirator-1. Non-party Conspirator-1 was a Director of National Accounts at Rippling before joining Deel as a Director of Partnerships in January 2024. At all relevant times,

Conspirator-1 was a resident of California. He was discovered to have downloaded sensitive information, including company product roadmaps and financial projects before his termination from Rippling, and later, against Rippling’s objections, used a forensics firm hired and paid for by Deel’s lawyers to delete records of this activity.

Conspirator-2. Non-party Conspirator-2 was a Senior Manager of PEO Solutions Consultants at Rippling before joining Deel as a Director of PEO Solutions Consulting in February 2024. Conspirator-2 is a resident of California. Conspirator-2 was in communication with several Deel executives as early as summer 2023, and, on information and belief, unlawfully solicited several former Rippling employees and documents after joining Deel, including by asking for sensitive information about Rippling and openly boasting about this activity to Deel employees, including Deel CEO Alex Bouaziz.

Conspirator-3. Non-party Conspirator-3 was an employee of Victim-3 (defined below) until early 2022. On information and belief, at the behest of Alex Bouaziz and in violation of Conspirator-3’s duty of loyalty to Victim-3, Conspirator-3 provided the Bouaziz Racketeering Enterprise with Victim-3’s “CRM” (i.e., its trade secret customer database, containing confidential and valuable nonpublic information about customers compiled by Victim-3, the value of which laid in its secret and nonpublic nature).

Conspirator-4. Non-party Conspirator-4 was an employee of Victim-3 (defined below) until approximately summer 2023. On information and belief, at the behest of Alex Bouaziz and Conspirator-3, and in violation of Conspirator-4’s duty of loyalty to Victim-3, Conspirator-4 provided the Bouaziz Racketeering Enterprise with Victim-3’s “CRM” (i.e., its trade secret customer database, containing confidential and valuable nonpublic information about customers compiled by Victim-3, the value of which laid in its secret and nonpublic nature).

The lawsuit now introduces 4 employees who are not named (but are easily doxxable and probably will end up testifying in court if it's not settled). Don't forget, this is a RICO case. In my very first article on the saga, I warned that this would have a fallout outside of just the Deel executive team.

Victim-2 (Toku). WorkCo, Inc. d/b/a Toku (“Toku”) is a Delaware corporation with its principal place of business in Delaware. Toku is a cryptocurrency-based tax and payroll compliance company, which filed a suit against its competitor LiquiFi in December 2024, alleging misappropriation of trade secrets and then filed a preliminary injunction in April 2025, alleging Deel CEO Alex Bouaziz’s participation in the overall scheme and desire to “crush Toku.”

Victim-3 (Start-Up Accelerator). Victim-3 is a startup accelerator that previously partnered with Deel.

Victims-4+ (Major EOR Competitors). Victims 4+ are one or more major competitors of Deel in the EOR (“Employer of Record”) market other than Rippling.

At minimum of 3 other companies are collaborating with Rippling around the case.

First, in January 2024, Deel hired Rippling’s former Director of National Accounts (Conspirator-1) as Deel’s new Director of Partnerships, shortly after his termination from Rippling for performance. During a routine security review, Rippling discovered that, in the late evening hours before his termination in December 2023, Conspirator-1 had downloaded a cache of highly sensitive trade secret documents, including product roadmaps and critical operational playbooks.

When Rippling demanded that Conspirator-1 return this information to Rippling (as his contracts with Rippling required) and informed Deel of these concerns, Deel’s attorneys and Conspirator-1 refused to take action. Further investigation revealed that the volume of documents taken was even greater than initially believed. Deel’s attorneys then suddenly informed Rippling that a third-party forensic investigator was hired to delete the documents rather than return them to Rippling, as required. On information and belief, Deel is funding Conspirator-1’s legal defense counsel, who represents Deel in separate matters.

Congratulations Don, you made to the lawsuit.

Source: “Conspirator-1” LinkedIn page

Indeed, the vibe was a bit different—less tech sales bro, more money Twitter scammers.

Source: Case No. 3:25-CV-2576 (CRB)

Second, in February 2024, Deel hired a senior manager from Rippling’s PEO team (Conspirator-2) as Deel’s new Director of PEO Solutions Consulting. On information and belief, at least eight months prior, in July 2023, Deel attempted to recruit Conspirator-2 to lead the development of its new PEO offering. At the time, because Conspirator-2 was a key individual on Rippling’s PEO team, Rippling offered him a retention package, which he accepted. On information and belief, Deel and Conspirator-2 remained in contact despite Conspirator-2 remaining at Rippling.

By early 2024, Deel returned with a new offer, one that was lucrative enough to prompt Conspirator- 2 to turn down a second retention bonus from Rippling. According to Deel whistleblowers, Conspirator-2 improperly retained confidential Rippling documents concerning Rippling’s PEO offering after leaving Rippling for Deel. On information and belief, Conspirator-2 did so in anticipation of payment from the Bouaziz Racketeering Enterprise once he joined Deel and provided the misappropriated documents to his new bosses when he arrived. Former Deel employees have told Rippling that, upon joining Deel, Conspirator-2 shared the misappropriated confidential Rippling PEO materials with Deel executives, including Alex Bouaziz. Moreover, Conspirator-2 went so far as to text one of his former colleagues to “do [him] a solid” and send him additional Rippling documents.

lol, guess not?

Source: The Deal Director on X

Deel’s misconduct has not been limited to employee poaching for information. Former Deel employees describe a company with virtually no internal controls around competitor information. Rather, these former employees report that they were “positively encouraged” to bring information from prior employers to Deel, and that Deel’s leadership would instruct sales teams to create fake email accounts through Gmail or Outlook, mimicking legitimate company domains to circumvent firewalls blocking known Deel traffic, to explore competitor products while masquerading as prospective customers—practices that are all expressly prohibited in Rippling’s policies and training.

Meanwhile, even if Deel employees encountered illicit conduct, per Deel’s public Whistleblowing Policy, they were instructed to contact “phb@deel.com” (the email address for Board Chair and CFO Philippe Bouaziz) or his consulting company Bouaziz & Partners.”

For Deel, lack of controls appears to be an intentional feature, not a bug. Taken together with the conduct at issue in this action, these practices reflect a deliberate pattern and practice by Deel to shortcut innovation through the misappropriation of the time, capital, and intellectual investments of its competitors.

Let's remind ourselves that this is an allegedly $1B ARR company specifically focused on payroll and compliance. While this was going on, the rest of us in the industry had to suffer through mandatory compliance trainings every six months in order to encourage us to come forward in any scenario of fraud. While the original complaint focused on the commercial leaks, the amendment introduces more details around how much critical information related to Rippling's roadmap and technology was stolen.

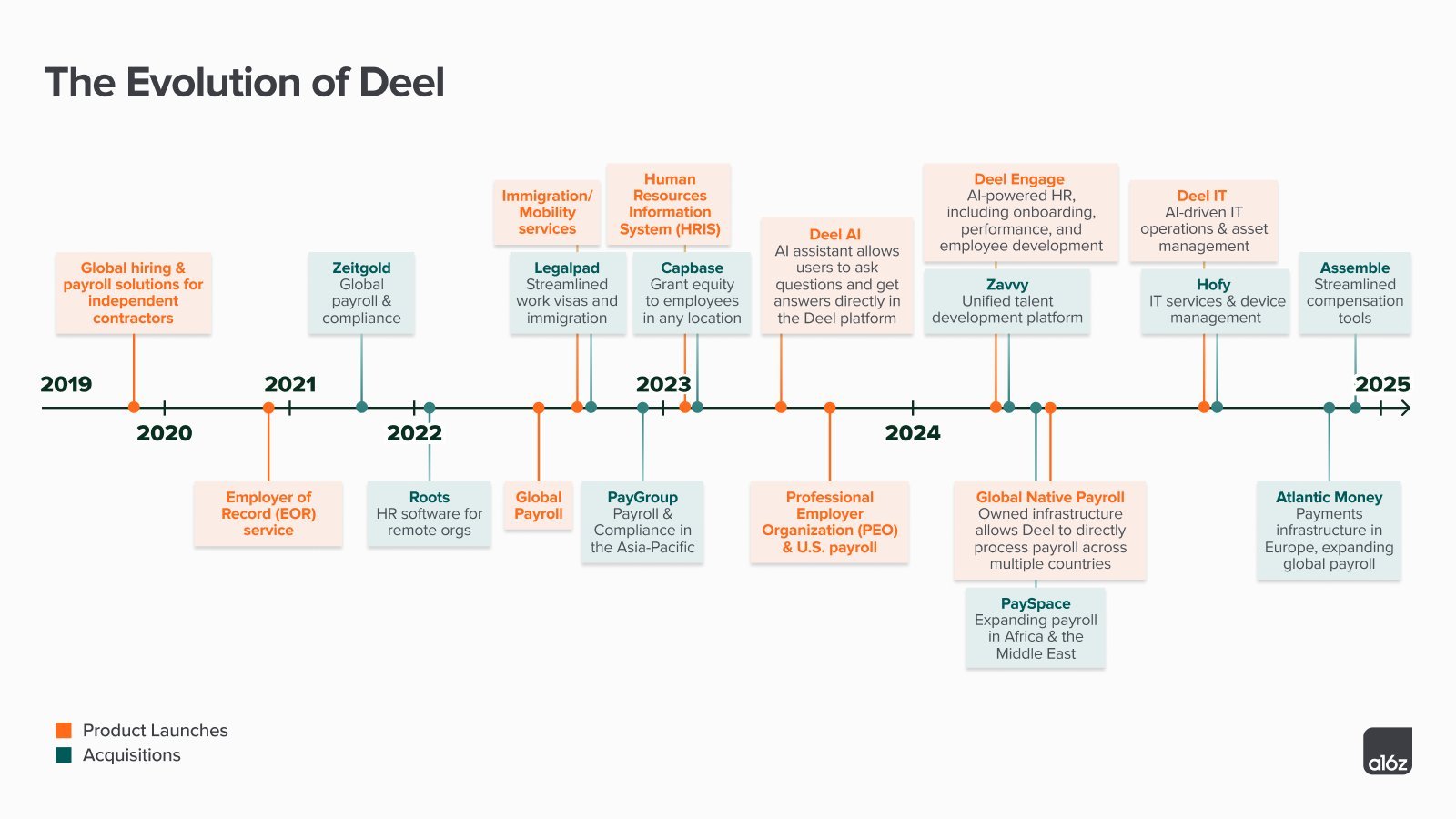

Alex Bouaziz sought to steal confidential information about Rippling’s strategy, and, in this particular example, he sought to learn how Rippling developed and maintained a successful native French payroll product, which had prompted one of Deel’s former customers to switch to Rippling based on Rippling’s superior product offering. Capitalizing on the stolen knowledge that Rippling’s native French payroll offering was earning Rippling a competitive advantage, Deel sought to regain ground, embarking on a marketing campaign through its largest investor to emphasize the native payroll solutions Deel offered through acquisitions, not built internally, like Rippling.

Before we expand on this, this is interestingly enough the first proper callout on a16z. They clarify here:

Deel’s largest investor, Andreessen Horowitz (also known as a16z), published a blog post titled, “Deconstructing Deel: How a Startup Became the OS for Global Work,” praising several aspects of Deel’s business model, including Deel’s use of acquisitions to acquire global native payroll offerings, lauding how “these acquisitions have paid off. The acquisition of PayGroup in 2022 and PaySpace in 2024, for example, enabled Deel to expand its owned infrastructure, including native payroll engines in more than 100 countries.” The day after Andreessen’s complimentary blog post, on March 11, 2025, Deel announced the acquisition of Safeguard Global’s payroll division.

Coming back to the roadmap:

O’Brien has confirmed that he stole Rippling’s product roadmap and Global EOR expansion roadmap and sent them to Alex Bouaziz, evoking instant excitement from Bouaziz, who responded “beast!”30 These stolen roadmaps are among Rippling’s most valuable internal assets, reflecting the expertise and efforts of large swaths of employees working cross-functionally to identify and operationalize the company’s key strategic priorities and offerings. For example, a product roadmap from February 2025, which O’Brien sent to Alex Bouaziz, revealed feature sets and go-to-market timing information for dozens of product initiatives that Rippling planned for its 2025 fiscal year. Similarly, the Global EOR expansion roadmap31 that O’Brien confessed he sent to Bouaziz at least three times, records comprehensive data on new geographic markets Rippling plans to enter, including launch date, scope of planned product offerings, and country-specific operational details.

Deel’s theft of these and other Corporate Strategy Trade Secrets simply repeated its tried-and-true unlawful growth strategy—why do it yourself, when you can steal it from your competitor? Alex Bouaziz commandeered O’Brien to steal Rippling’s key corporate, product, and global development plans. And the theft of these prized internal assets has deprived Rippling of the value of its hard-fought efforts, instead diverting these efforts for Deel’s own benefit. Alex’s reaction, “beast!”, upon his receipt of this stolen information, makes clear that he fully understands the value of what he wrongfully obtained. He knows that the roadmaps, plans and insights will spell out for Deel which product offerings Rippling believes are in highest demand among its customers, the approximate time and complexity they will take to design, build and launch, and how Rippling plans to position them to the market. Armed with this information, Deel is competing with Rippling using Rippling’s own proprietary trade secret information.

Funnily enough, they lean in on Jason Calacanis to explain why this matters:

As a noted tech investor recognized in The Week Startups Podcast, for software-as-a-service (SaaS) start-up companies like Rippling and Deel, getting your hands on a competitor’s product roadmap is the most valuable discovery imaginable:

● Alex Wilhem (Journalist): “Jason, in terms of the crown jewels, if you are a reporter, the crown jewels is getting someone’s income statement, right? But if you are a competing SaaS provider, this is what you want.”

● Jason Calacanis (Seed Investor): “The product roadmap [if stolen] is extremely damaging . . . . Some of it might be obvious but it would give you the ability to front-run announcements and then it would give you the ability to say to investors or to your team or to your customers, in other words, your constituents, ‘Look, we released these three features. Rippling is just a fast follower, they copy us.’ So you could really damage [Rippling CEO’s reputation] and Rippling’s reputation in this case by making them look like a fast-follower, when in fact, you are.

While trade secrets and commercial information were useful, they were clearly not enough. The next step was aggressive attempts at stealing employees:

Acting on Bouaziz’s instructions, O’Brien stole contact information for high-performing Rippling employees from across the company, including members of his Global Payroll Operations team and Rippling’s Product team. Bouaziz and Westgarth immediately activated= this information to begin aggressively soliciting the referenced Rippling personnel via LinkedIn and, when provided mobile phone numbers, WhatsApp.

Indeed, between January 29 and February 17, 2025, at least 17 members of Rippling’s Global Payroll Operations Team and at least 4 Global Product and Operations leads were solicited directly by Deel executives and at least ten reported receiving job offers. Several team members reported that these offers were made without any substantive interview, and only after repeated, unsolicited contact from Deel’s COO Dan Westgarth. Some of these team members were contacted directly via WhatsApp, a messaging application that requires knowledge of a person’s mobile phone number to send a message—and many of these numbers were provided by O’Brien at Alex’s request.

Source: Case No. 3:25-CV-2576 (CRB)

“Deel speed” yet again.

Notably, former Deel employees have informed Rippling that it is widely-known at Deel that Deel deliberately recruits talent from competitors with the expectation that they bring confidential materials from their prior employers to Deel. Indeed, a former Deel employee recalls Westgarth, a key architect of Deel’s poaching employees to steal competitor confidential information pipeline, presenting a Rippling confidential sales strategy document internally at Deel.

This is a new claim as part of the amendment and probably the worst one from the perspective of average employees. Particularly when we look at how other companies experienced attention from Deel:

Victim-3. Shortly after Rippling’s initial Complaint, Victim-3, a start-up accelerator, informed Rippling that Deel had stolen the start-up accelerator’s “CRM” (i.e., its trade secret customer database, containing confidential and valuable nonpublic information about customers compiled by Victim-3, the value of which laid in its secret and nonpublic nature). This start-up accelerator had entered into an exclusivity arrangement with Deel, where, under the arrangement, Deel contractually bound the start-up accelerator to require its start-up customers to partner with Deel to manage their contractor payroll needs. During the course of the partnership, across 2022 and 2023, Deel poached two employees to join Deel, and soon after their departures, this start-up accelerator learned that these two employees had each stolen the accelerator’s CRM and brought it to Deel to support their efforts to drive business development at Deel, working in close partnership with Alex and Philippe Bouaziz. When this start-up accelerator confronted its former employees about the theft, the former employees both cited generous compensation offers from Deel, nearly tripling their prior salaries, in order to bring the accelerator’s confidential start-up partnership and CRM data to Deel. When this start-up accelerator confronted Deel, Deel challenged the accelerator to try to sue to enforce its rights, referencing that Deel had a large legal budget and would vigorously oppose any legal claims about the incident.

While startups are used to getting outcompeted by other, better-funded ones, typically that's related to headcount and technical capabilities. Getting your CRM info stolen, employees poached and then told to go away or they'll sue you is, well, a different kind of experience.

O’Brien began receiving compensation for his spying activities in November 2024, when he received a bank transfer of $6,000 from an “A.B.” via Revolut, a British financial technology company that specializes in online payments. Documentary evidence from Revolut establishes that “A.B.” was Alba Basha, the wife of Deel COO Dan Westgarth.

At least founders who had their companies targeted by Deel can be safe knowing that the whole Deel family is together in this journey.

Source: a16z

Let's not forget, respect for the entrepreneur and the company-building process defines a16z. The past few months are showcasing this, for better or worse.